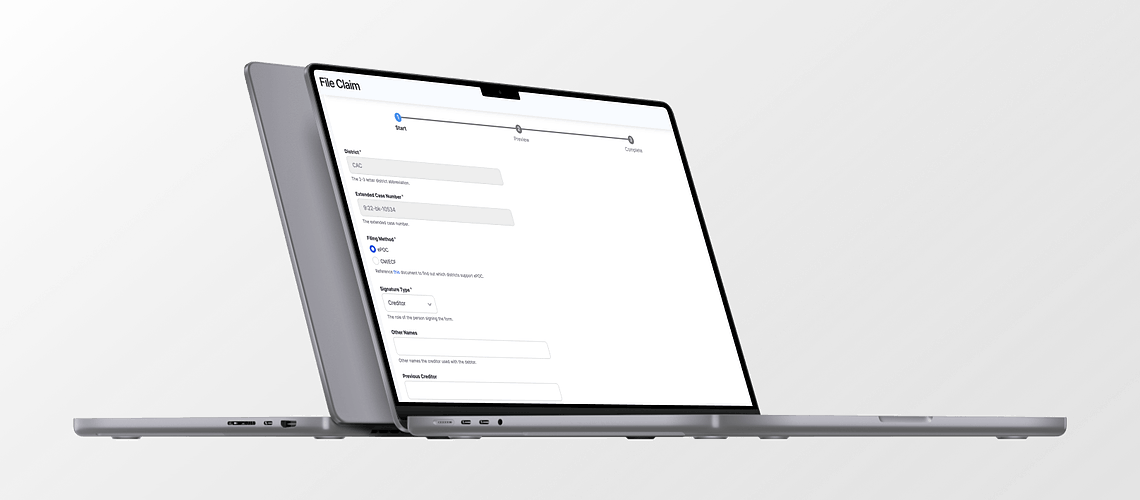

Filing creditor claims through PACER and the 94 CM/ECF district websites can be a frustrating process for lenders. After working with lenders for years, we've heard many of the same complaints. Here are some common issues that lenders face when filing claims, and some suggestions for improvement:

- Navigating 94 districts is annoying: Lenders often have to search for the correct district website, determine whether the district accepts EPOCs, and locate the correct link in the often cluttered court website menus. The process can be so cumbersome that some lenders have found it easier to snail-mail their claims.

- There are too many fields: The claims forms often include many irrelevant fields, making the process intimidating. It would be helpful if the form displayed fields based on the answers to previous questions. For example, a lender filing an unsecured claim shouldn't have to read through and understand all the nuances of secured claims.

- Save the address: It would be more convenient if the address population function was as smooth as Amazon's 1-click checkout. Instead, filers often have to deal with conflicting Chrome auto-fill attempts, particularly when the organization and signature addresses are different. The process becomes even more chaotic when a creditor has to file claims for multiple lenders.

- More automation: The court's claim process is highly manual and doesn't facilitate automation tools or SOR integrations. It would be helpful if the claims filing process could be incorporated into tools that lenders already use.

- CM/ECF breaks (way too) often: Many lenders have to use Microsoft Edge just to file claims because of bugs in some ePOC forms that only allow submission from that browser. These bugs are routed through the court and can get stuck at the federal level, causing frustration for lenders and making the whole process more complicated.

- Smarter notifications: The CM/ECF notification system is unreliable. Notifications can be missed, and when a lender does receive a notification, they often have to try to re-locate the case within the CM/ECF website. It would be helpful if there was a smarter connection between the notification and the filing process.

- It isn't clear how to redact information: Some lenders have been sued because they didn't properly redact sensitive information. PACER should provide a tool to help lenders redact documents, or at least point them to a safe place to do so.

- CM/ECF websites are ugly (with the exception of CAE): Many of the programs used for filing claims are stuck in the 90s and could benefit from some design updates to streamline the experience and make spending hours filing claims less dreadful.

- Accessing filings is expensive: Even the most organized filers may forget to save their claim and claim receipt. It is wild to have to pay to review their own claim.

- Creditors should get default access to free looks: Bankruptcy attorneys have free access to PACER filings and documents. It would be helpful if creditors were automatically granted the same privileges.

- As part of the courts’ general anti-hacking strategy, they only allow a certain number of ePOC claims to be filed each day. The allowable number varies by district and can be wildly different. 10 claims in one district, 500 claims in another. To combat this, many lenders have to race to file their claims early in the day.