Weekly Update

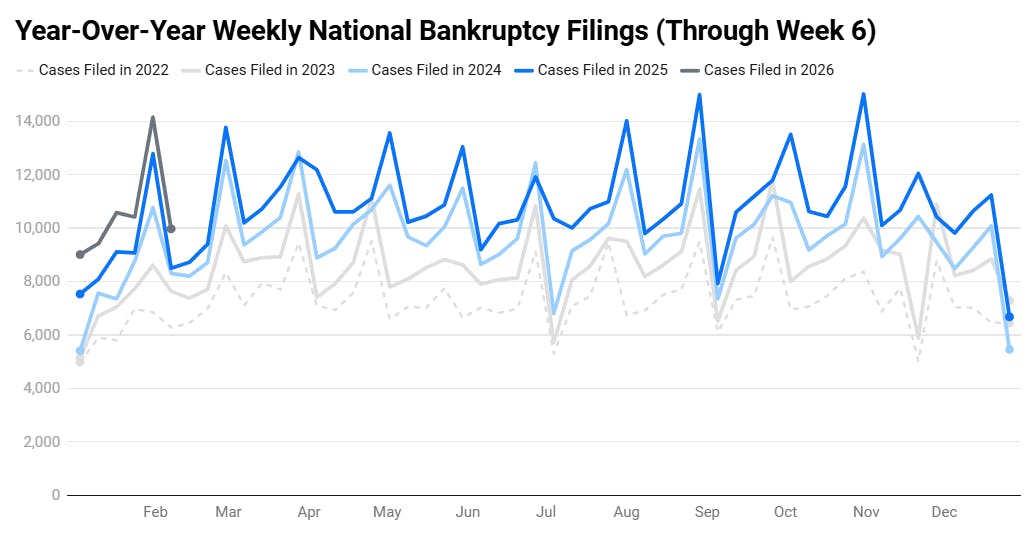

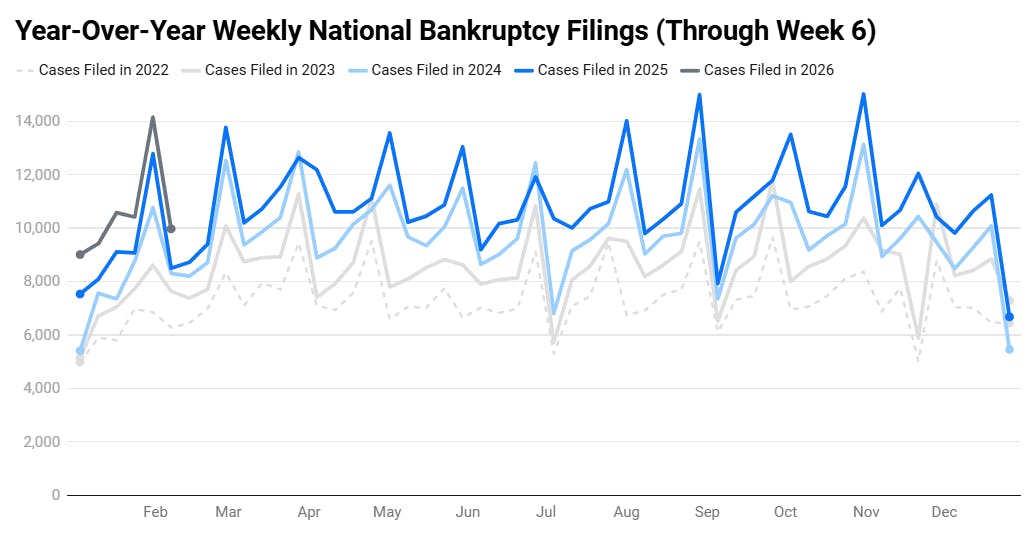

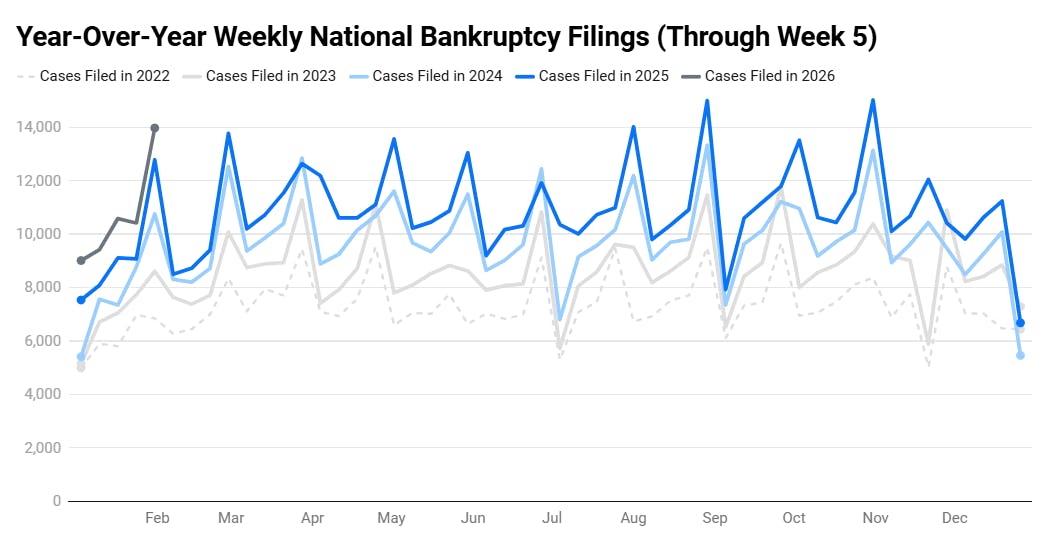

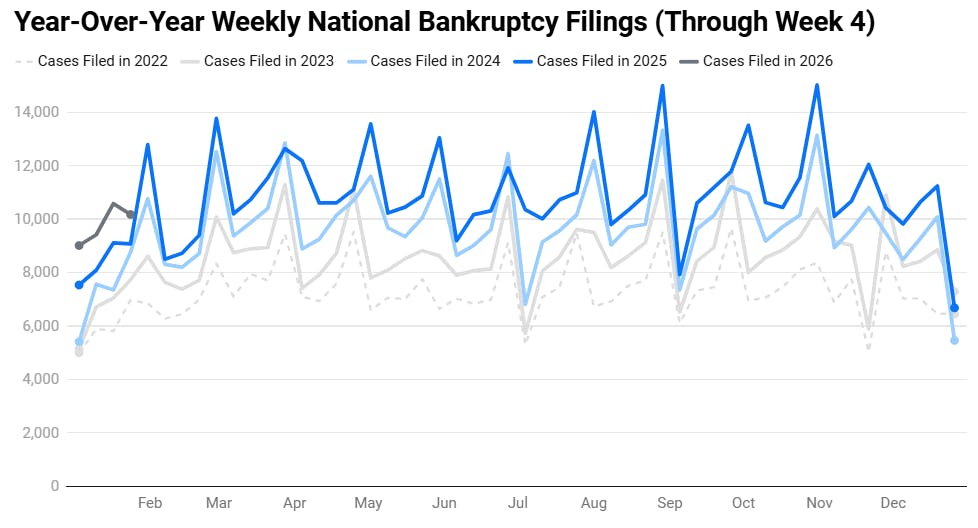

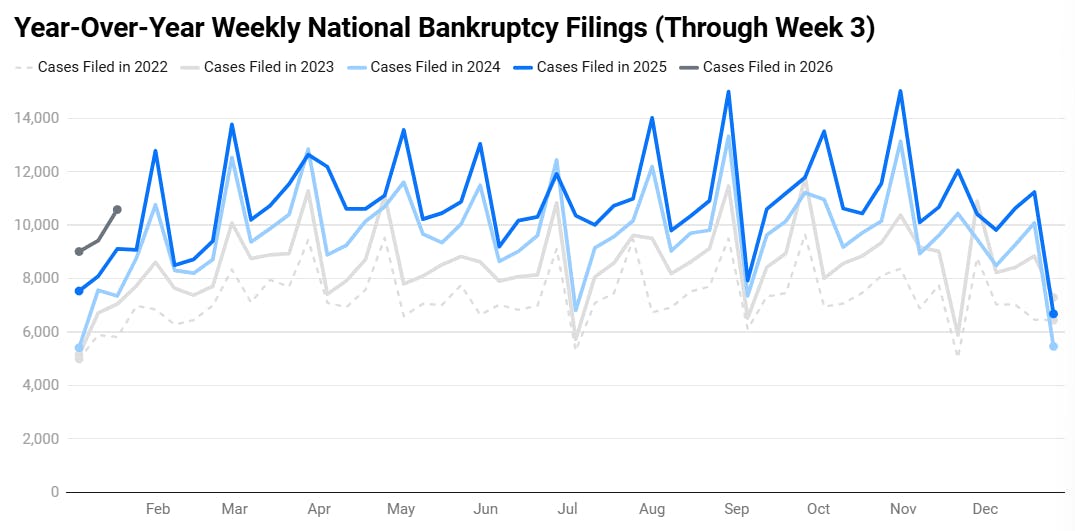

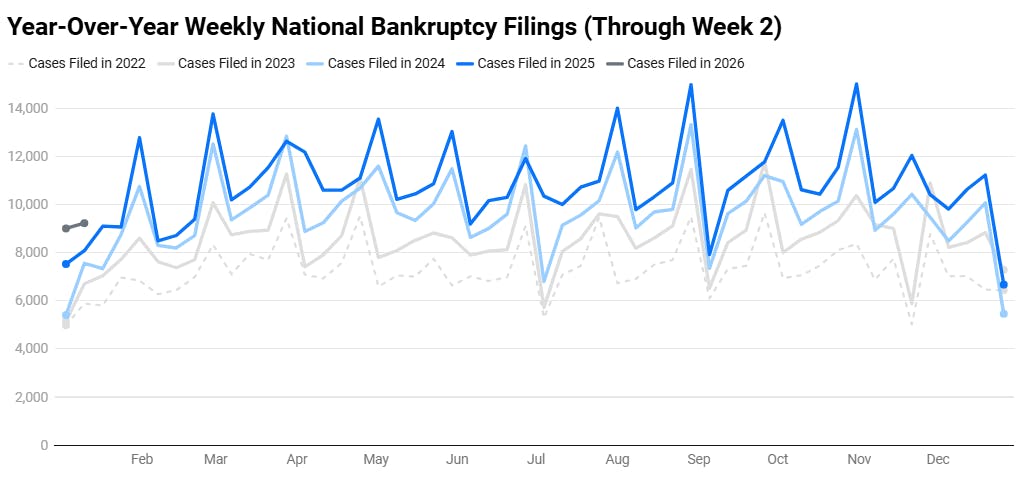

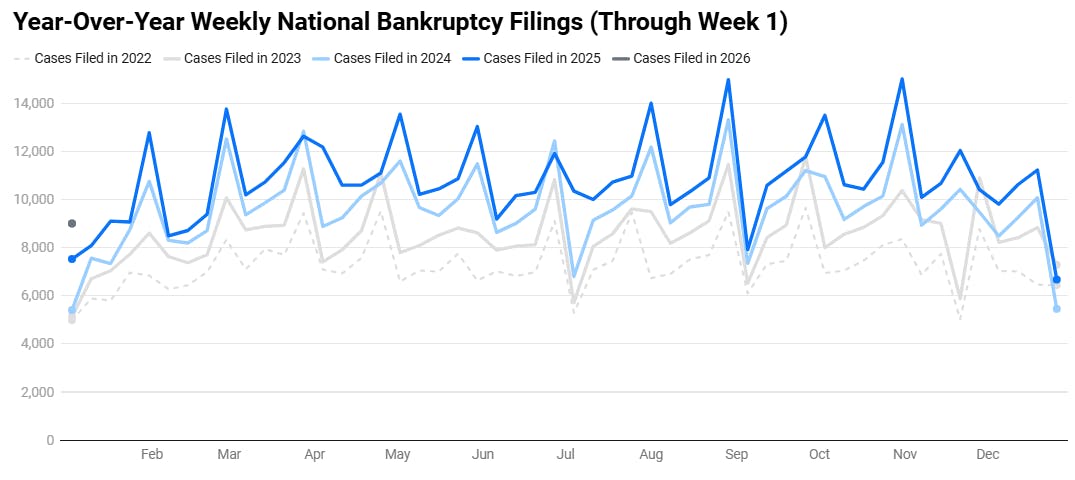

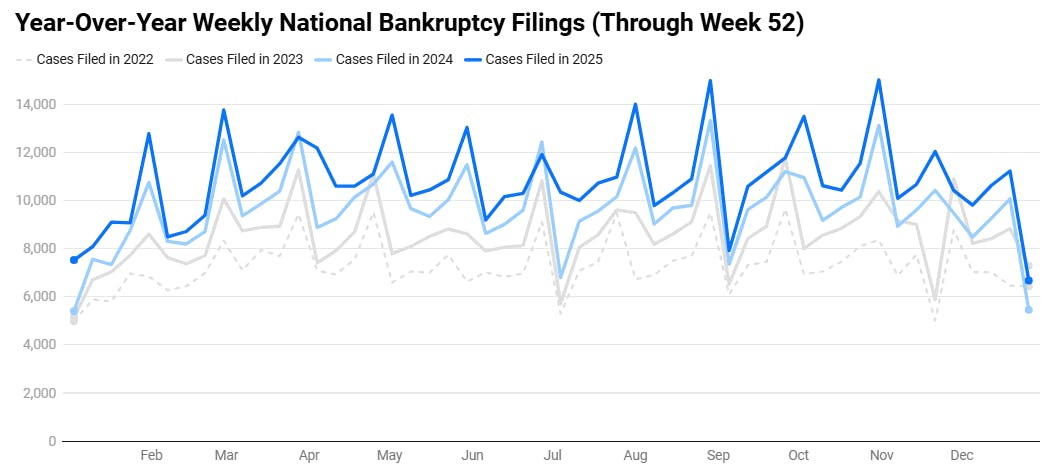

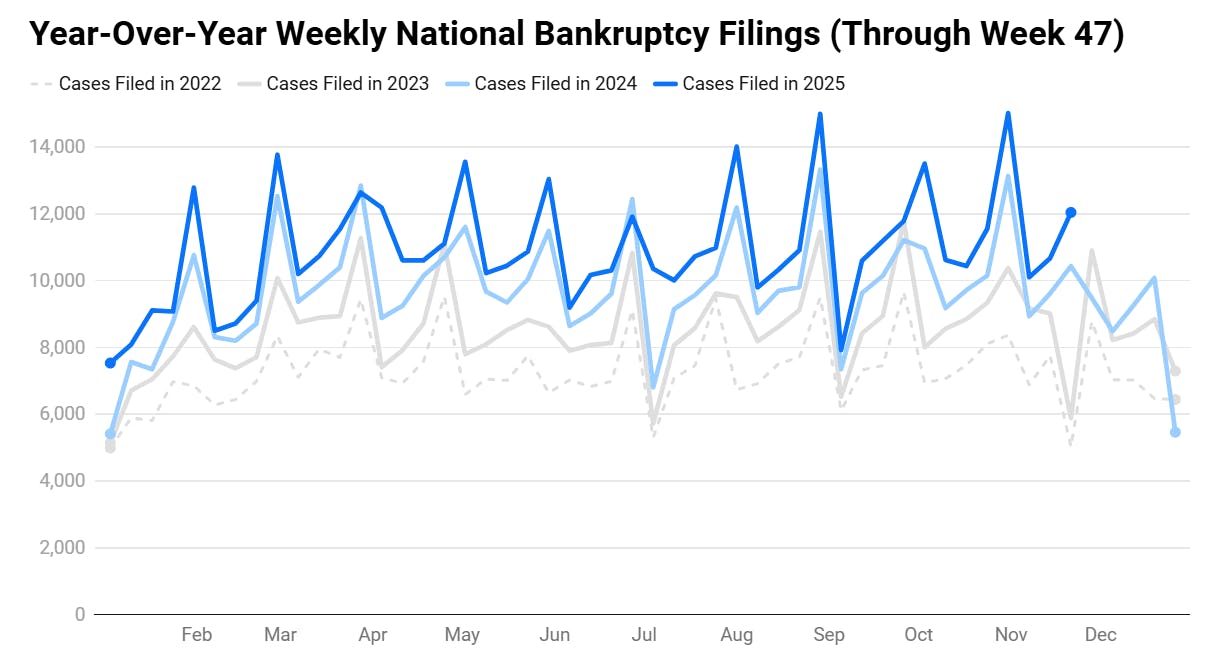

2026 Week 06 Bankruptcy Report

Marco Varela

February 9, 2026 · 5 min read

Real-time bankruptcy statistics to help you make better business decisions, faster. Industry market research reports, statistics, analysis, data, trends, and more.

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela

Weekly Update

Marco Varela