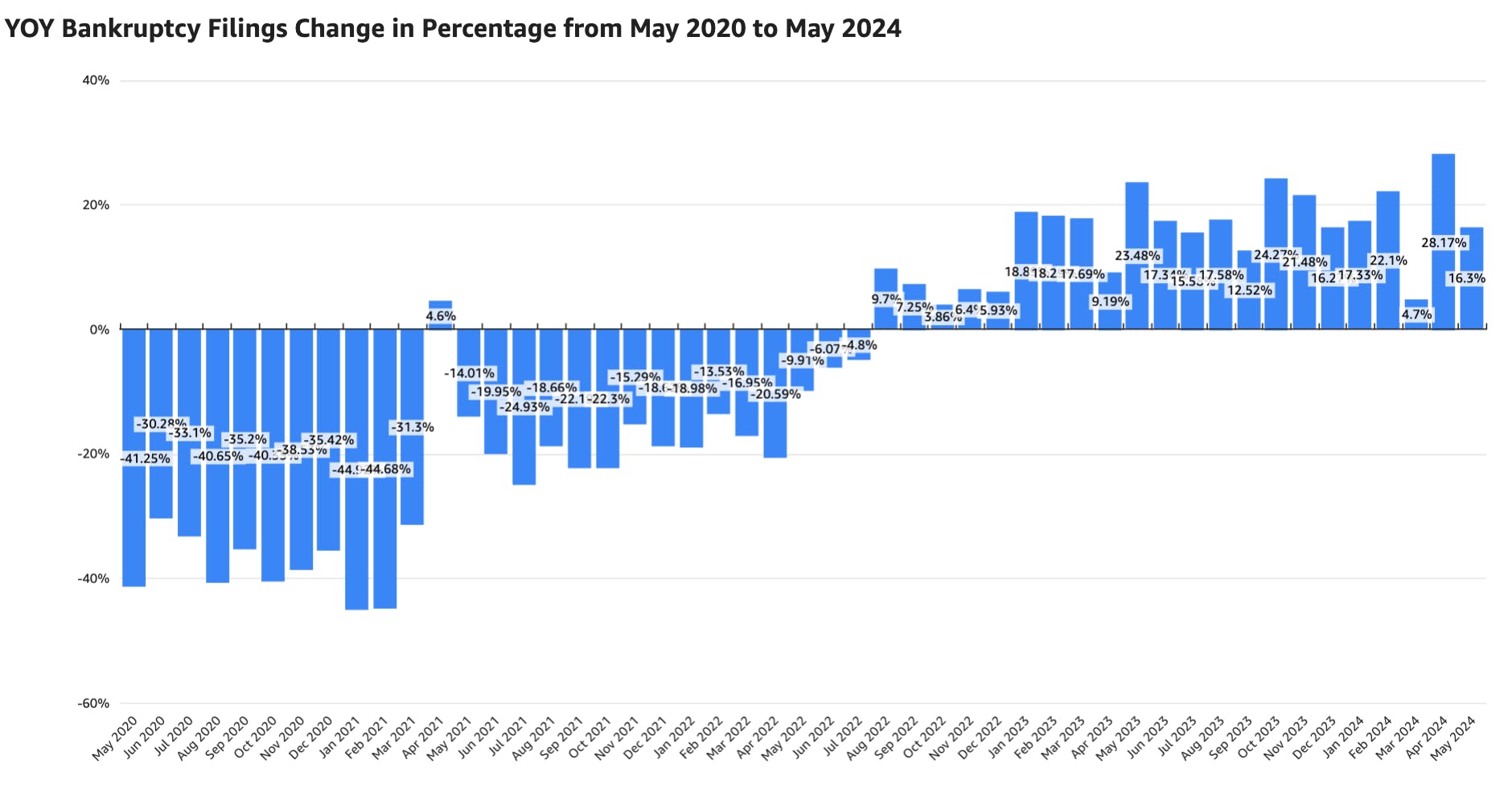

Bankruptcy filings have been on a double-digit year-over-year upward trajectory for the last couple of years, but it is important to see the bigger picture.

During the pandemic, we saw the largest drop in bankruptcy filings in decades. For example, in 2020, it was common for bankruptcies to see monthly filings drop over 40% year over year.

While we see a rise in bankruptcies, we consider this rise more of a recovery from where bankruptcies were in 2019 and before. If bankruptcies were to continue to rise at current rates, it would be many months before we reach 2019 levels and many more before we get close to 2010 levels.

This is not to say that the rise in bankruptcy filings is not a cause for alarm. Many companies and law firms had to adjust staffing to accommodate the lower filing volume. With bankruptcy filings rebounding, they find themselves restaffing (or modernizing) to deal with the changing filing volume.

Forecasting the trajectory of bankruptcy filings is a complex task, given the multitude of factors at play. While certain elements could fuel an increase in filings (e.g. resumed collections on student loans, increased unemployment, decreased access to credit, increased inflation), there are also factors that could mitigate this trend (e.g. forbearances, more stimulus, consumer credit availability, decreased interest rates, loan forgiveness).

We provide the necessary technology to adapt to any volume of bankruptcy filings. Our mission is to assist law firms, banks, credit unions, and all entities dealing with bankruptcy workflows in seamlessly integrating bankruptcy automation into their existing processes.