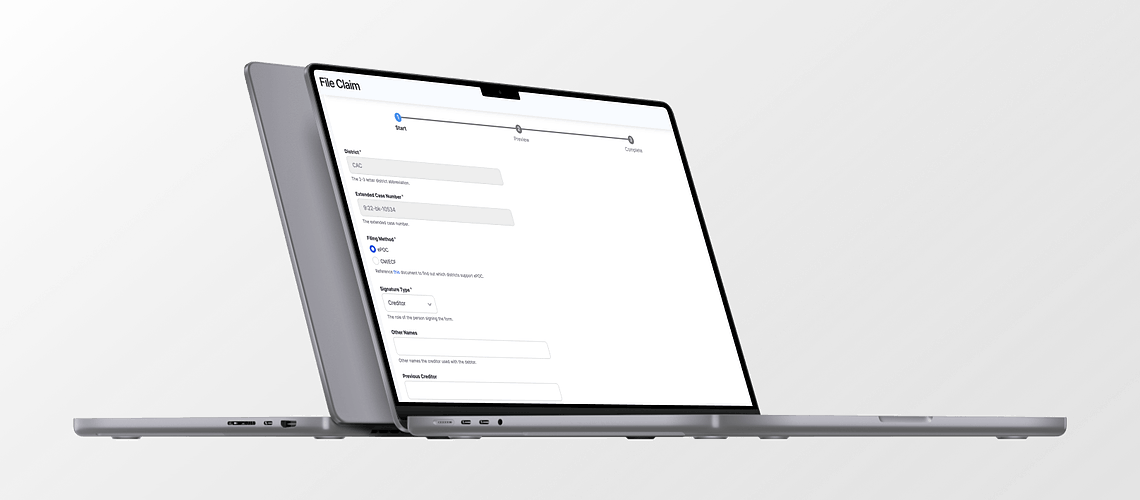

Platform provides a single form to file claims in any district through a single form. Here's how it works:

How to File a Proof of Claim on Platform

Ryan Stone

Ryan Stone

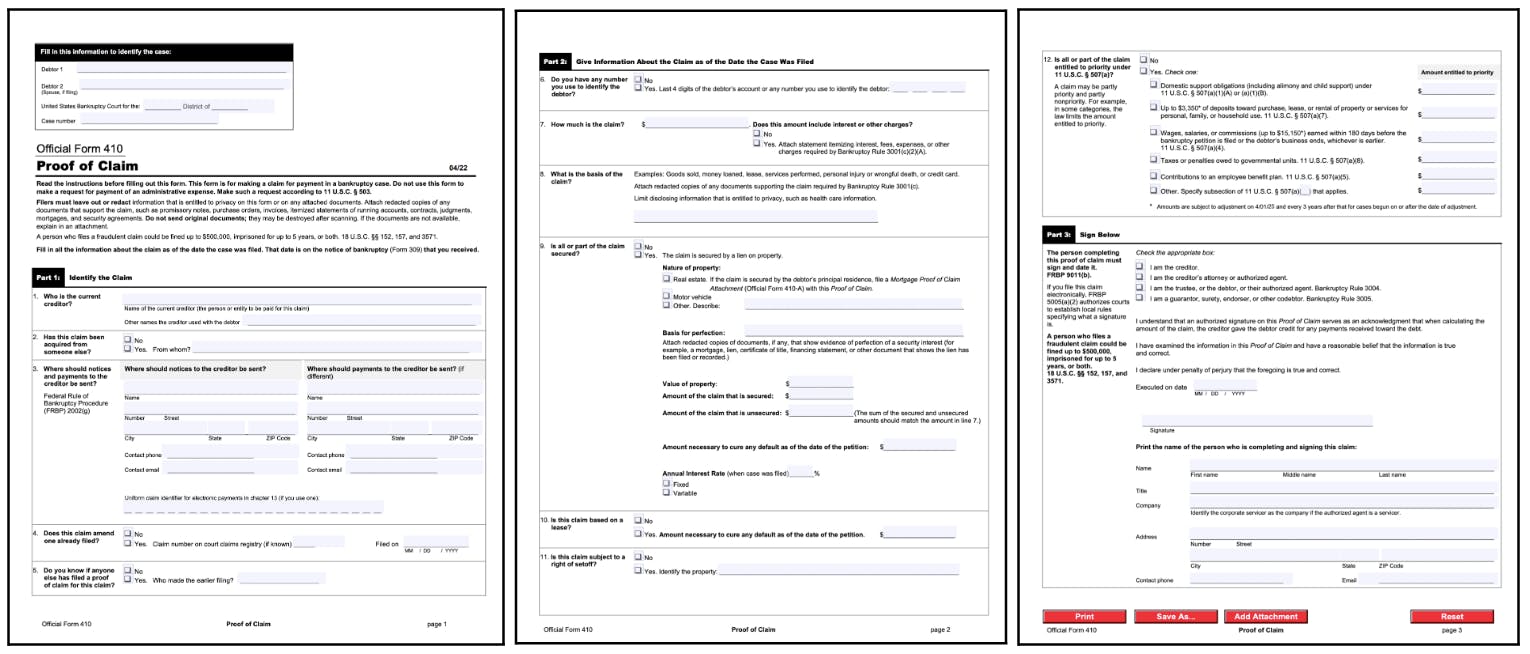

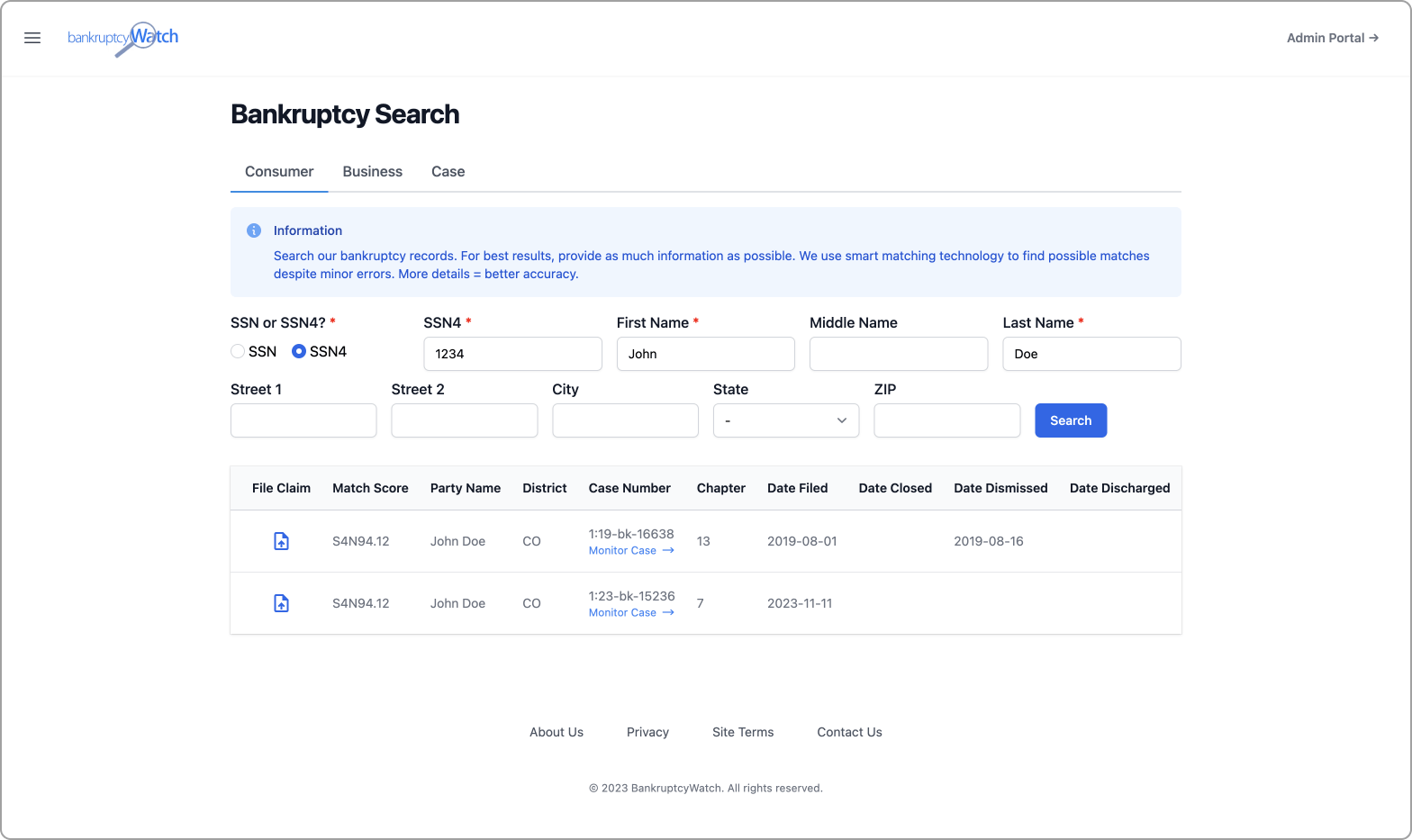

1. Locate the case

First, you want to locate the case where you want to file a Proof of Claim. The case can be found through a notification from our consumer monitoring service or on the Case Search Page. Once you have found the relevant case, you can click the claim button to navigate to the form and import all of the relevant bankruptcy case details.

- District: This is where the district where the case was filed. This is automatically populated when you select a case.

- Extended Case Number: the extended case number for the case. This is also automatically populated when you select a case.

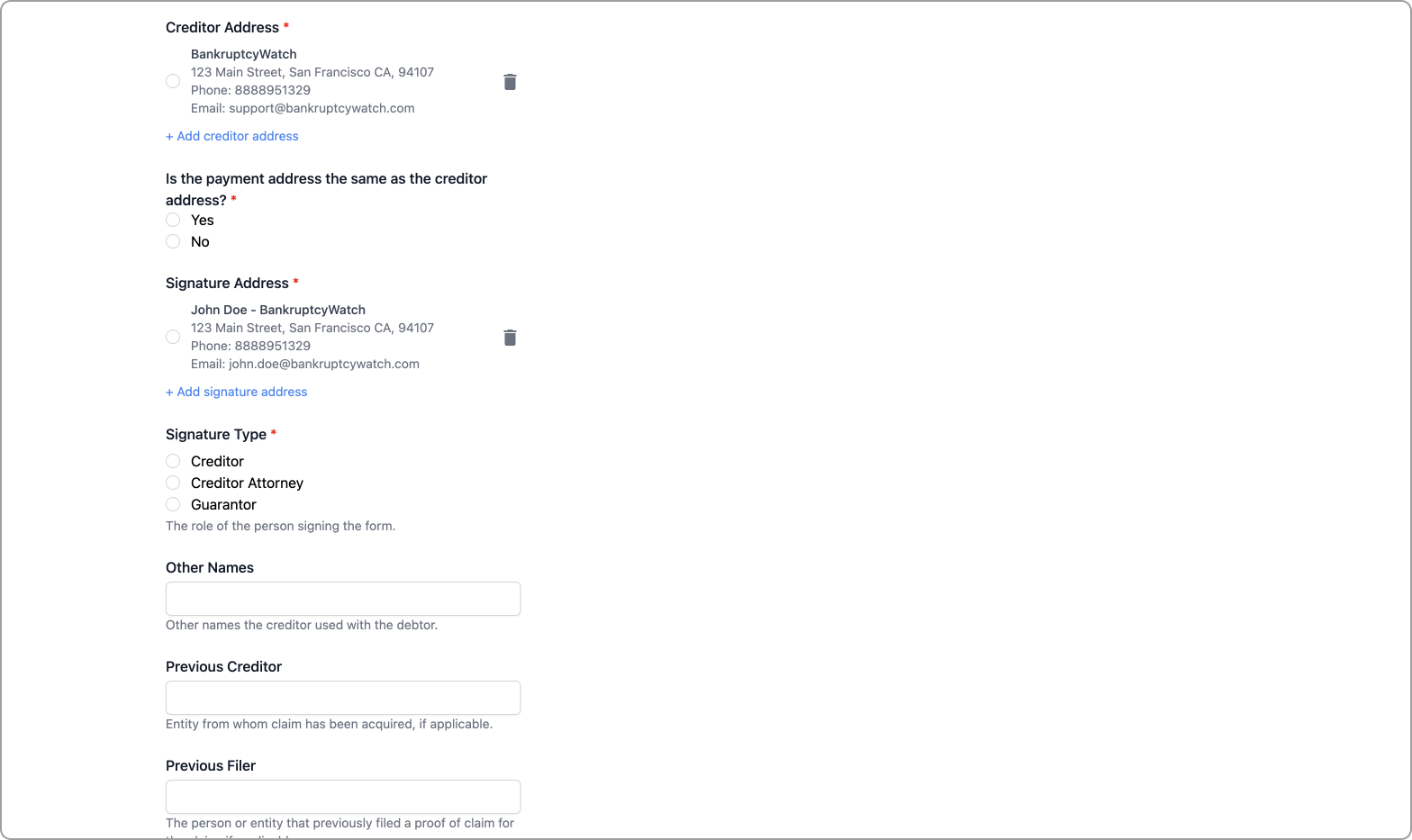

2. Add the Creditor Information

Start by adding the address for the company. We store address information, so you can quickly reselect the address in future forms.

- Creditor Address: Who is the current creditor? Include the creditor name. 3rd party servicers often put {SERVICER} / {LENDER}.

- Payment Address: Where should notices and payments to the creditor be sent? It is very important to identify the correct person and address to receive notifications. Consumer bankruptcies generally move very quickly with short deadlines to respond. Include the address of the creditor. Include the address where payments should be sent if different.

- Signature Address: The address of the person signing the form. Submitting this form has the same legal effect as filing a claim using CM/ECF or submitting a signed proof of claim form at the courthouse.

- Signature Type: Identify the signor’s authority to sign the claim.

- Other Names: Is there another name the creditor used with the debtor? Specify that here.

- Previous Creditor: Has this claim been acquired from someone else? This is where creditors must disclose if a debt was acquired from another company or person. You should be prepared to disclose the evidence demonstrating you own or are authorized to file the claim.

- Previous Filer: Do you know if anyone else has filed a proof of claim for this claim? Occasionally, a different proof of claim may be filed for the same debt.

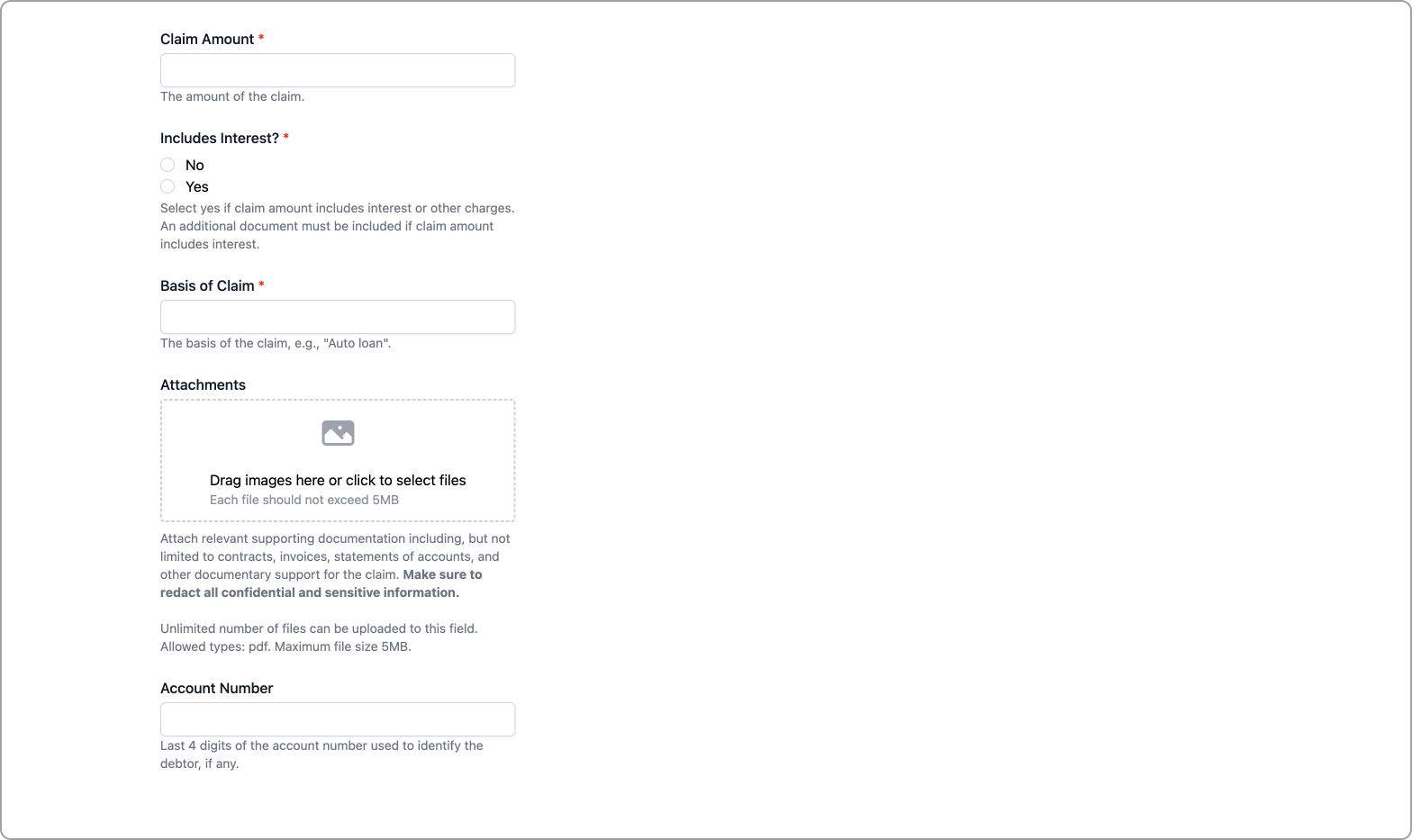

3. Include the Claim Amount

Give Information About the Claim as of the Date the Case Was Filed.

- Claim Amount: How much is the claim? Identify the amount the debtor owed as of the date the bankruptcy was filed. Do not include any amounts that may have come due after the bankruptcy was filed.

- Includes Interest: Select yes if claim amount includes interest or other charges. An additional document must be included if claim amount includes interest. If the amount includes interest, penalties, or fees you must check the box. In addition to the claim, you must provide a detailed breakdown of these additional charges.

- Basis of Claim: What is the basis of the claim? This is where you describe why the debtor owes you money. Make sure to include documentation for the basis of the claim. If the claim is based on any type of written document, Bankruptcy Rule 3001(c) requires that a copy of the document(s) be filed with the claim. If the writing is lost or destroyed, then include a statement of the circumstances of the loss or destruction with the claim. E.g., if your answer is “Money loaned,” then include the agreement the user signed to acquire the loan. Don’t disclose private information (see the redaction section below).

4. Upload Your Attachments

It is important to include supporting documentation for your claim. Often this consists of the agreement/promissory note and the most recent statement. This also includes a detailed breakdown of any additional fees added to the total like interest, penalties or fees. There is also a requirement to redact any information that may contain personal identification information. Make sure to review and redact all information according to Bankruptcy Rule 9037. The following information should not be redacted:

- The last 4 digits of the account number

- The last 4 digits of the SSN or TIN

- The birth year

All other personally identifiable information should be redacted. Once redacted, creditors compile the supporting documents with the claim and submit everything to the Court.

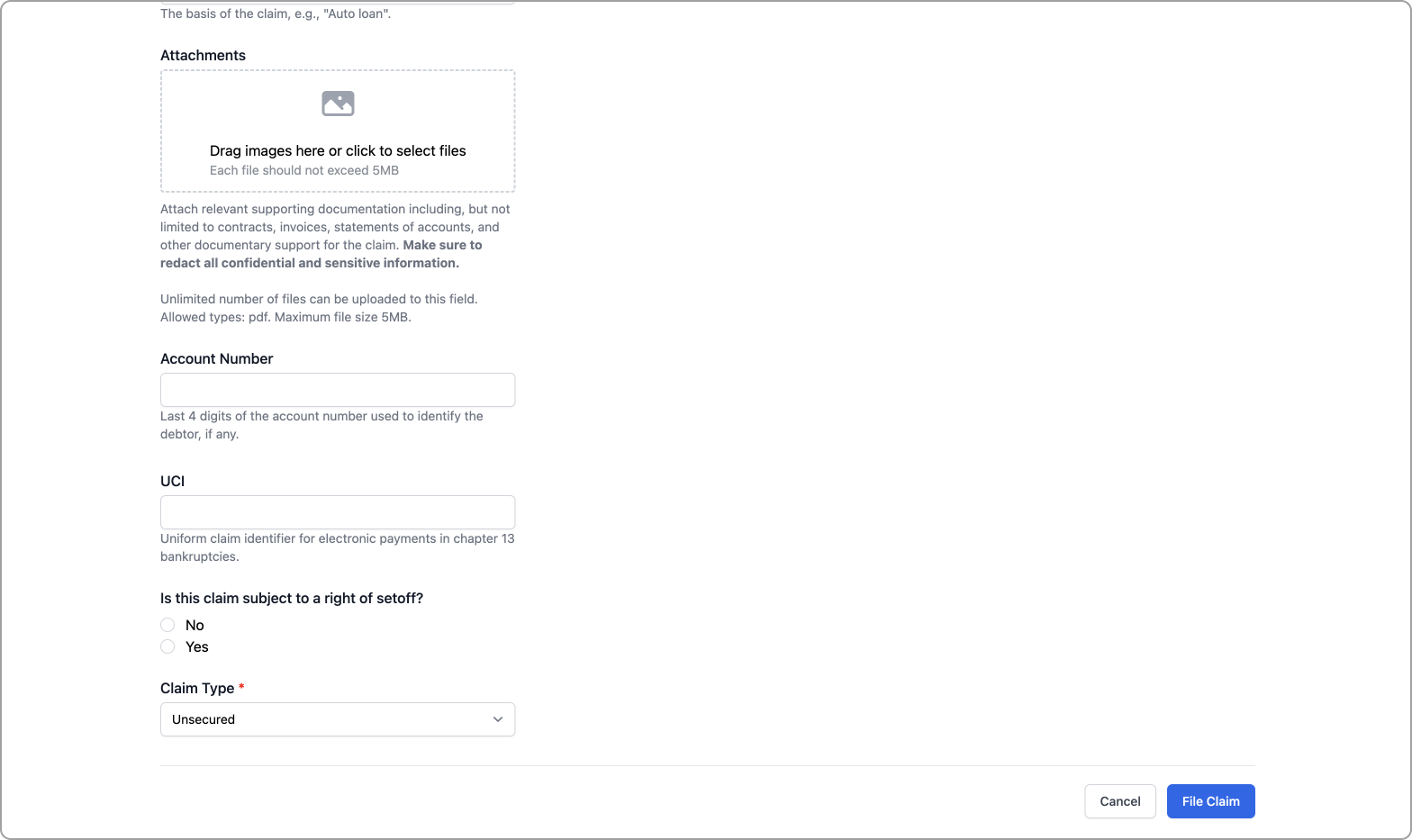

5. Include Some Additional Information

- Account Number: The last 4 digits of the account number used to identify the debtor, if any.

- UCI: In a chapter 13, a creditor may have a uniform claim identifier to facilitate electronic payments from the trustee.

- Is this claim subject to a setoff?: A setoff is an equitable right of a creditor to deduct the debt owed from the debtor the amount the creditor owes the debtor. For example, if the debtor has money deposited at the same bank where the debtor has a credit card balance, the bank should indicate whether it has the right to a set-off. Do not set off these amounts however until you have permission from the bankruptcy court and have discussed the set off with legal counsel.

- Claim Type: Include the type of claim here. Options include unsecured, lease, secured by real estate, secured by vehicle, or secured by other. Your answer may prompt additional questions.

There may be additional questions that are displayed depending on the type of debt selected in the "Claim Type" field. Reach out to us for an advanced guide for those.

We hope this helps! Contact us if you have any questions.

______________

Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. When you fill out the form, you are responsible for making sure that the information provided is correct. BankruptcyWatch is not responsible for errors in your filing.