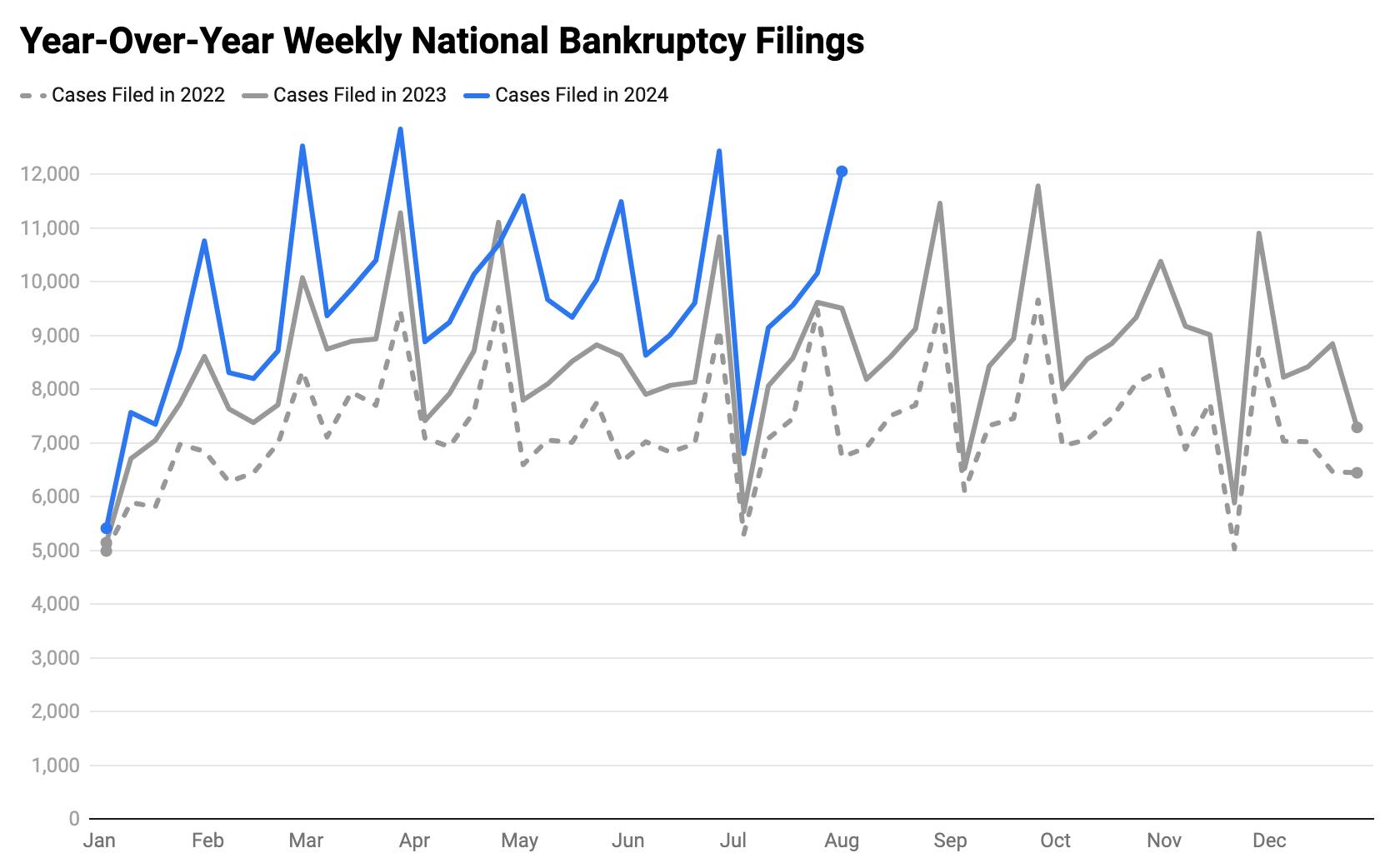

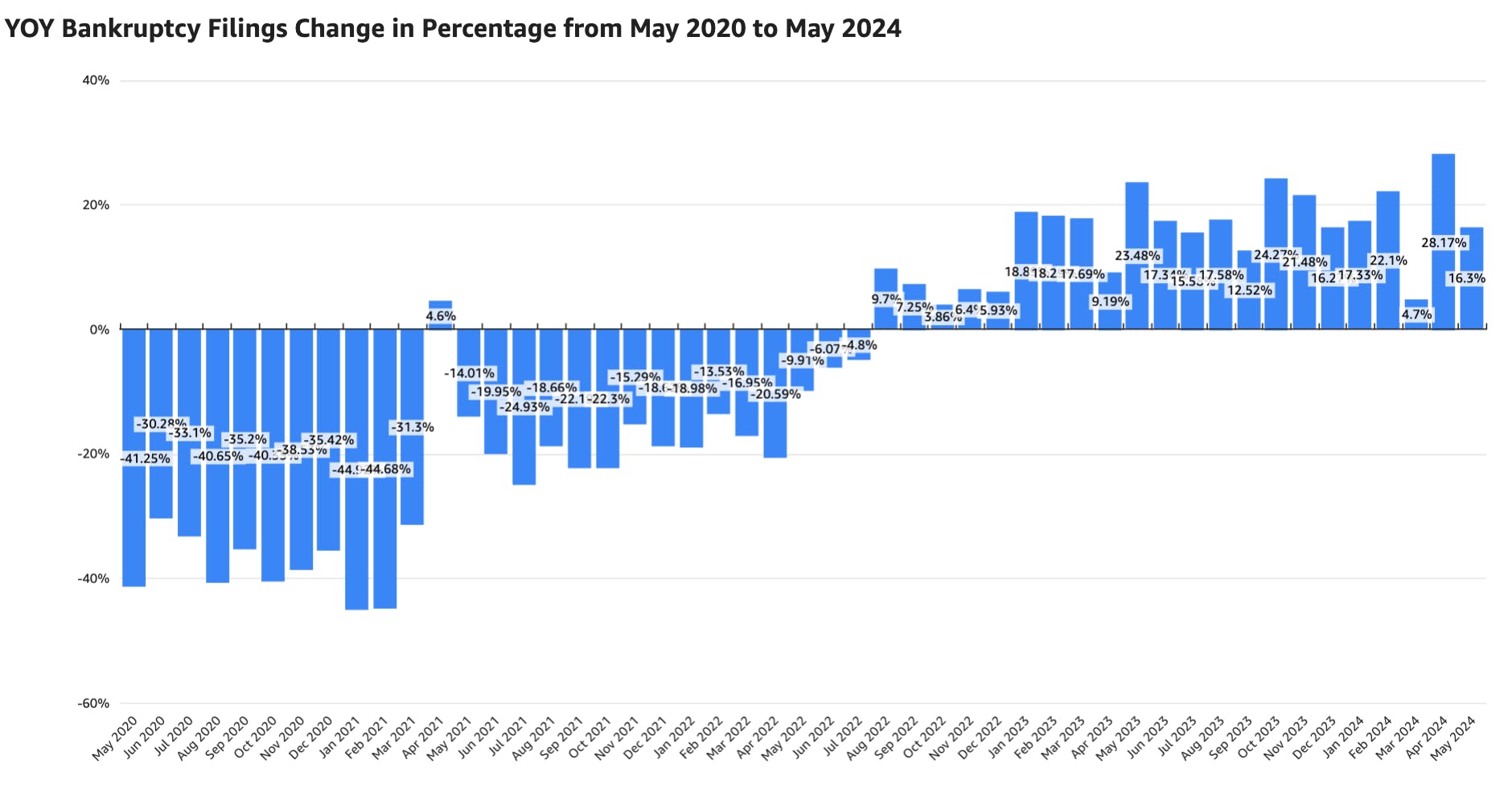

We have seen steady, double-digit increases in bankruptcy filings for years as bankruptcies continue to rebound from their historic lows during the pandemic. During Q3 2024, we continued to see this trend with significant filing increases across most chapters and jurisdictions, resulting in the highest filing quarter since the COVID-19 pandemic.

REPORT

The BankruptcyWatch Statistics & Trends Q3 2024 Report

Ryan Stone

Ryan Stone

Consumer bankruptcy filings rose in the third quarter of 2024, with Chapter 7 filings increasing 0.51% and Chapter 13 filings up 2.67%. Business cases, however, declined with Chapter 11 and 12 filings each down ~16% from the previous quarter.

Chapter 7 Filings

The uptick in Chapter 7 filings is significant given that Q2 typically sees the highest filing numbers due to tax filing implications. In fact, Q2 Chapter 7 filings had consistently exceeded Q3 numbers for the previous 5+ years. This year's reversal of that seasonal pattern underscores the intensity of the current increase.

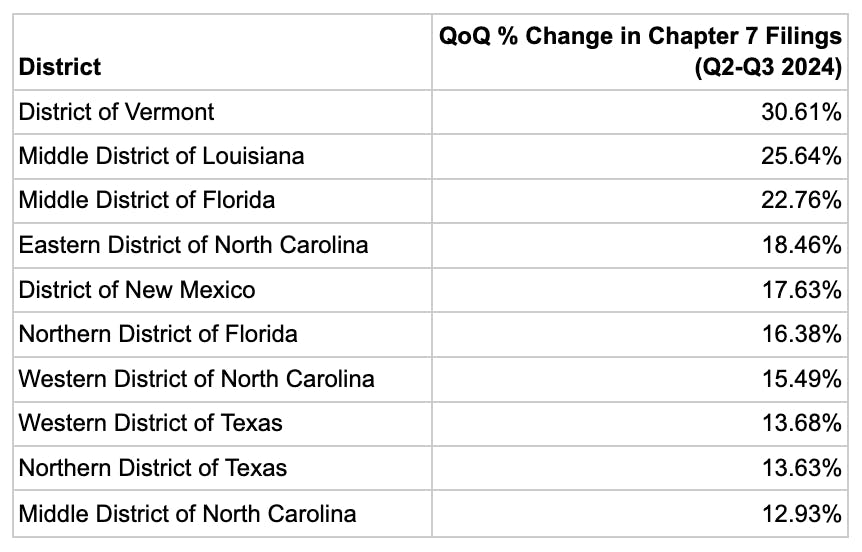

The national +0.51% increase in Chapter 7 filings doesn't tell the whole story. Breaking the quarterly filing difference down by district illustrates the diversity of impact across different regions with districts in Vermont, Florida, Alabama, Louisiana, Texas, and North Carolina seeing double-digit quarter-over-quarter increases.

Top 10 increases:

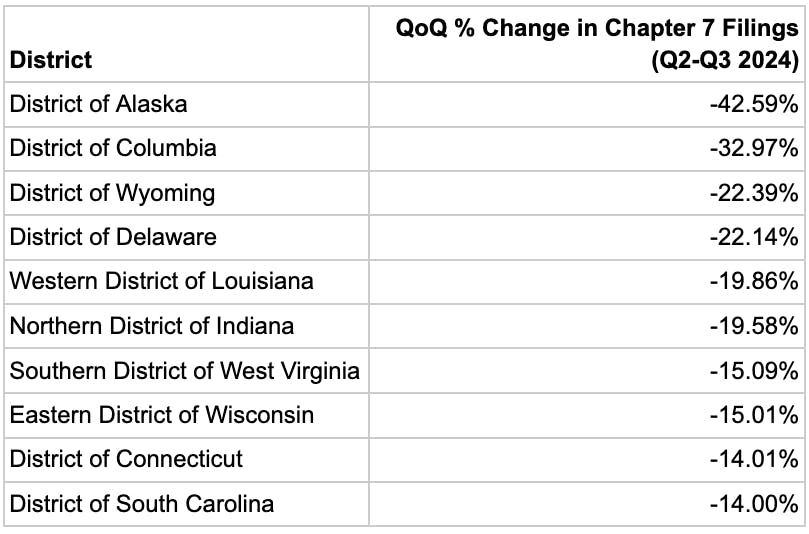

Conversely, some districts saw massive decreases in Chapter 7 filings. Districts in states like Alaska, Wyoming, Wisconsin, Missouri, South Carolina, and Arkansas saw double-digit drops in quarter-over-quarter filings.

Top 10 decreases:

We see the rise in consumer bankruptcy filings as a lagging indicator resulting from consumers being pushed to their financial limits. According to TransUnion's Q3 report, rising living costs, increasing housing and insurance expenses, high interest rates, and mounting debt in both credit card and auto loan sectors has led many to leverage their credit lines more than ever. The strong job market has been supporting the rising debt levels, but continued debt at high interest rates combined with cracks in employment have pushed an increasing segment of consumers over the edge to bankruptcy.

2. Year-over-Year Changes

Looking at the year-over-year changes gives us a clearer picture of the change in filings when you extend the timeline and eliminate seasonal fluctuations. Quarter 3 saw a dramatic increase in filings across the board, with Chapter 7 filings up +19.12%, Chapter 13 filings up +9.18%, Chapter 11 filings up +25.99%, and Chapter 12 filings up +92.59%.

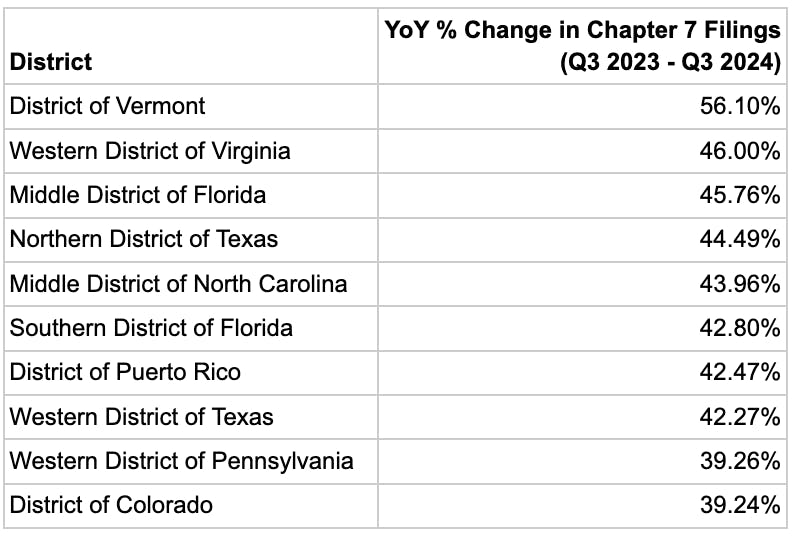

Chapter 7 Filings

The increase in Chapter 7 filings is dramatic, with districts in Vermont, Virginia, Florida, Texas, North Carolina, Pennsylvania, and Iowa seeing over 30% year-over-year increases.

Top ten increases:

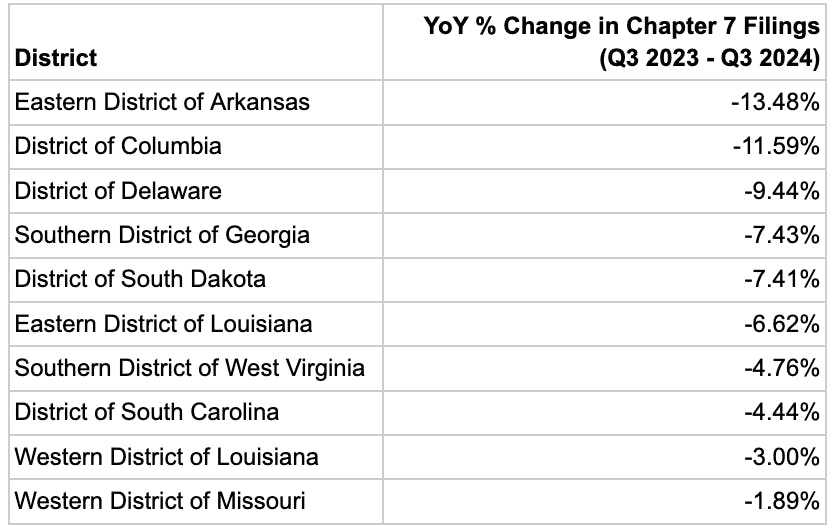

Few districts saw a decrease in filings. Here are the top ten decreases (minus the Virgin Islands):

Chapter 13 Filings

Chapter 13 filings continue to see steady growth despite policy shifts that make it slightly harder to be eligible to file Chapter 13. In June of 2024, the debt thresholds for Chapter 13 and Chapter 11 Subchapter V were adjusted due to the expiration of the Bankruptcy Threshold and Technical Corrections Act (BTATC). This law had previously raised the Chapter 13 debt limit to $2.75 million without separating secured and unsecured debts. As a result, the limits reverted to pre-2020 limits, which capped unsecured debts at $465,275 and secured debts at $1,395,875 for Chapter 13 filings.

Interestingly, some districts like the Middle District of North Carolina, the Southern District of Iowa, and the Middle District of New York saw decreases in Chapter 13 filings while seeing increases in Chapter 7 filings. One possible explanation for this difference is the post-covid rise in the cost of living has disproportionally affected those without a strong income and/or property that has benefited from the rising cost of living in these areas.

3. Return to 2019 Filing Numbers

Only in the last two/three years have we seen consumer filings return to pre-pandemic levels. While consumer filings have seen large year-over-year increases, we are still relatively far from 2019 filing levels. At the current rate, consumer filings won't return to 2019 levels until around 2026. There are, however, a couple of factors that could accelerate that timeline:

- Consumer access to credit may be the #1 factor for predicting bankruptcy filing. We are already seeing a shift toward tightened credit access.

- The restart of student loan payments will likely strain consumer budgets.

- Delinquencies are on the rise. The robust job market currently supports debt payments, but things could change quickly if economic conditions worsen.

Chapter 7 Filings

Chapter 7 filings have seen the steepest drop-off since 2019. The number of Chapter 7 filings in Q3 of 2022 was less than half the amount from the same quarter of 2019. This is likely the result of increased property value, a strong labor market, and the general increase in wealth in the years since 2019.

The only district that is above 2019 Chapter 7 filing levels is the Northern District of Texas, which is only up +4.44% likely driven in part by the increase in population during the same time period.

Chapter 13 Filings

During the pandemic, Chapter 13 filings tanked; however, they were the fastest to recover with a 44% increase from Q3 in 2021 to the same quarter in 2022. Many of the districts with the highest growth during that period are now seeing the year-over-year growth taper out.

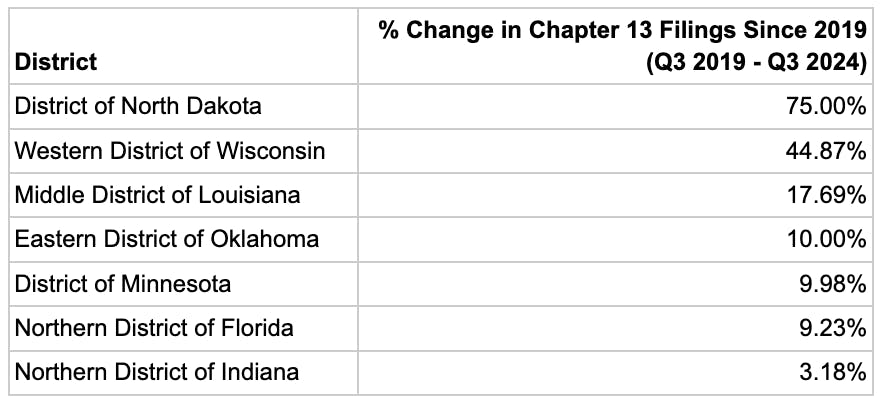

Interestingly, there were some districts with more filings in Quarter 3 of 2024 than in the same quarter of 2019.

The districts that saw an increase in Chapter 13 filings compared to Q3 2019:

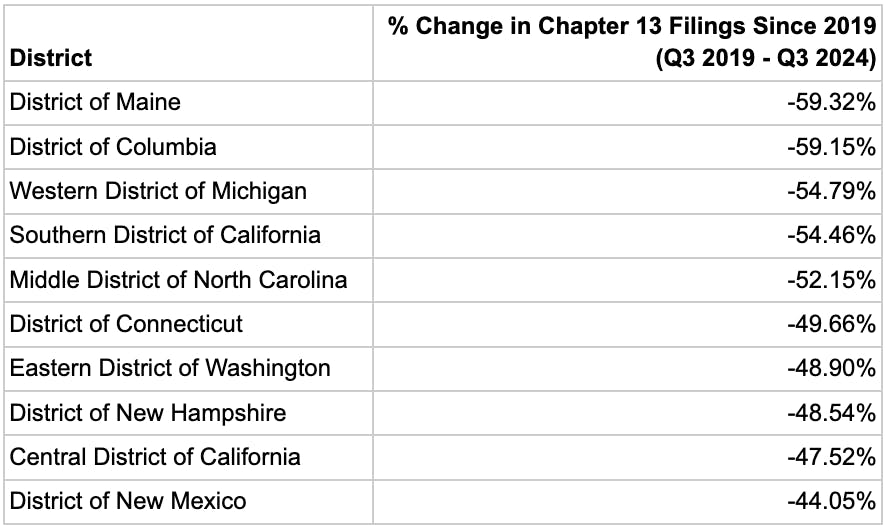

The districts that saw the most significant decrease in Chapter 13 filings since 2019:

Chapter 11 Filings

In contrast to consumer filings, Chapter 11 filings have increased by over 46% in Q3 of 2024 compared to Q3 of 2019. This rise was likely driven by high inflation, rising interest rates, and increased operating costs. Many small to medium businesses, especially in retail, hospitality, and commercial real estate, faced added pressure from supply chain disruptions and shifting consumer demands. For companies struggling with debt yet aiming to stay operational, Chapter 11’s restructuring flexibility has offered a critical lifeline amid these ongoing economic challenges.

4. Market Trends We're Seeing

Potential Bankruptcy Inflection Point

Household debt has reached an all-time high of $17.8 trillion, driven by record levels in mortgage, auto loan, and credit card balances. Meanwhile, consumer savings rates have significantly declined since their COVID-era peaks. We are seeing the impact of these factors through the rising delinquency rates. A downturn in the labor market or further inflationary pressures could trigger a significant rise in both Chapter 7 and Chapter 13 filings.

Shift from Mortgage-Driven to Consumer Credit-Driven Bankruptcies

During the previous decade, mortgage defaults were the primary driver of bankruptcy filings, as seen in the 2008 financial crisis. However, current reports like TransUnion’s August Credit Industry Snapshot saw serious consumer-level delinquency rates increase across products, except for mortgages. Unlike in past downturns, where mortgage foreclosures pushed filings, we now see bankruptcies tied entirely to credit defaults, a sign that everyday expenses and revolving credit create unsustainable debt loads for many consumers.

Increased Use of Home Equity as a Financial Buffer

According to a recent report from InvestmentNews, nearly half of U.S. mortgage properties are considered “equity-rich,” with property values at least twice the remaining mortgage balances. Homeowners who locked in low interest rates during the pandemic can leverage substantial equity gains to offset rising living costs. This buffer allows many homeowners to avoid bankruptcy by accessing cash via refinancing or home equity loans. Consumers without the safety net from low mortgage interest rates and appreciated property value are facing a much bleaker outlook.

Population Shifts Impacting Bankruptcy Hotspots

The recent uptick in bankruptcy filings in high-growth regions may be partially influenced by population migration to states with favorable tax laws and attractive housing markets. As people continue relocating to these areas, the sheer increase in population alone can drive up filing numbers, creating a statistical impact on bankruptcy rates. Even without significant changes in local economic conditions, more residents inherently mean more potential filings, amplifying the appearance of financial distress in these high-growth regions compared to areas with stable or declining populations.

5. Market Trends We're Seeing

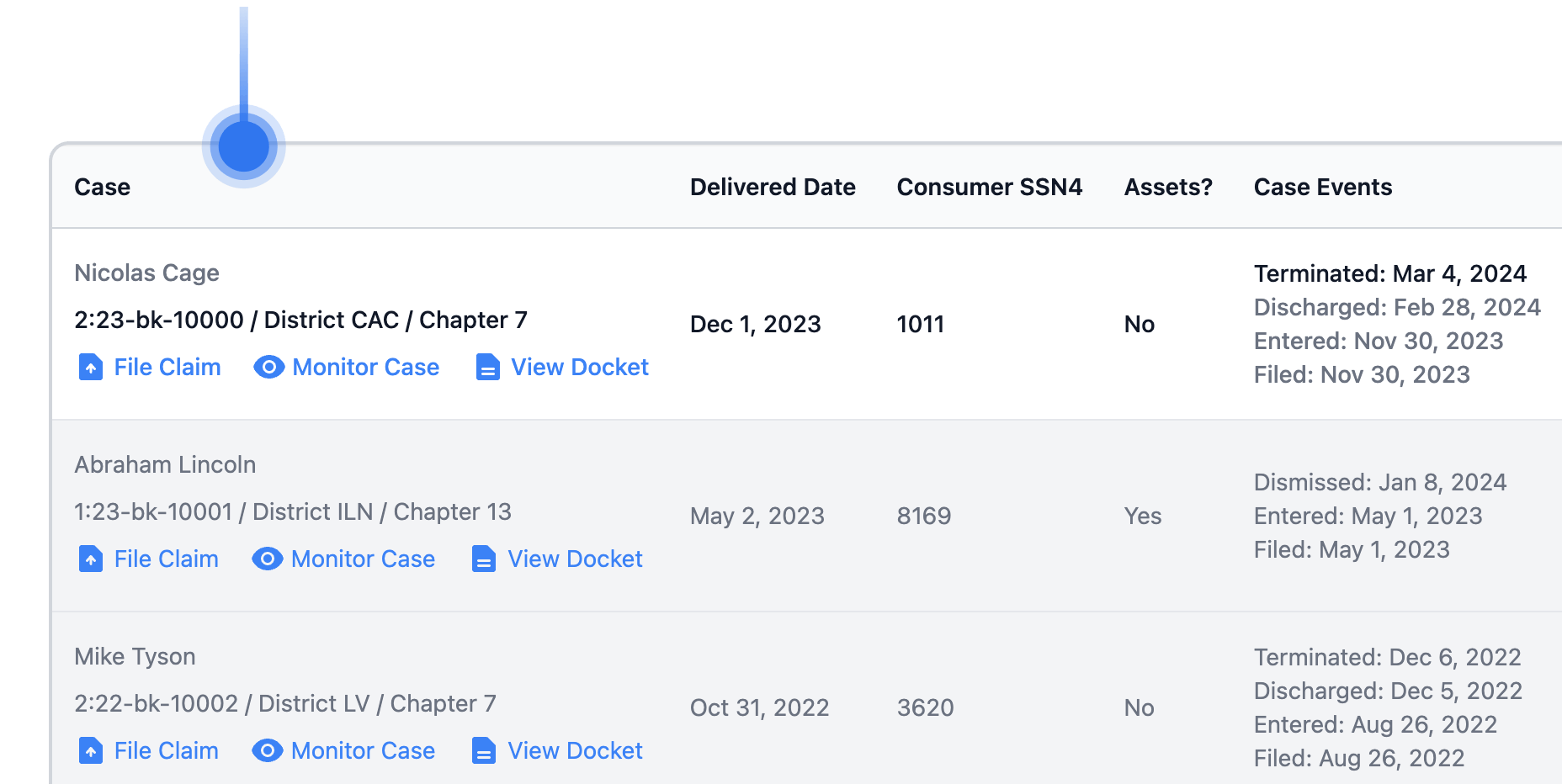

Utilizing APIs to Automate Bankruptcy Operations

As we’re increasingly seeing, automation through APIs is reshaping the way bankruptcy operations are managed. By leveraging APIs, financial institutions can automate critical workflows like filing updates, case monitoring, and data syncing across platforms, drastically cutting down on manual tasks and reducing the potential for error. While the cutting-edge fintechs were the first to embrace APIs, we've now seen law firms and financial institutions across the spectrum begin to use APIs to automate and integrate their workflows.

Integrated Bankruptcy Management

Integrated bankruptcy management systems are becoming essential as institutions juggle multiple tasks across various departments and systems. A unified approach allows for seamless coordination between collections, legal, and data teams, enabling them to manage every stage of a case from start to finish within one streamlined system. With bankruptcy integration, all teams have access to the same data and insights, reducing redundancies and ensuring that no critical information slips through the cracks.

APIs vs. SFTP

The choice between APIs and SFTP (Secure File Transfer Protocol) boils down to the speed and type of data transfer needed. APIs offer a real-time, always-on connection that’s ideal for dynamic operations where immediate updates and quick response times are crucial. On the other hand, SFTP remains useful for secure, high-volume data exchanges that don’t require real-time access, making it a solid choice for certain bulk data transfers. Each method has its place, but as the industry leans toward real-time data access, APIs are becoming the go-to choice for modern bankruptcy operations, keeping teams informed and agile in a fast-moving landscape. Luckily, we work with both!